Suggested Procedures for Determining

And Refunding Repossession Surpluses

And For Collecting Repossession Deficiencies

INTRODUCTION

Dealerships are legally required to refund the surplus remaining upon disposition of a repossessed vehicle and are limited in the circumstances and amounts of deficiencies they may collect from a defaulting debtor. Each dealer should consult with its attorney regarding the exact legal requirements applicable in the state where the dealership operates.

The following are procedures, which General Motors recommends that dealers follow in determining surplus amounts to be paid to customers, and deficiencies, which dealers may collect, in connection with the disposition of repossessed vehicles financed through a recourse financing plan with any financing institution. These recommended procedures are designed to help assure dealership compliance with legal requirements. Since the law may change and may vary among the states, the dealership’s attorney should periodically review these procedures to determine whether additional or different procedures should be followed.

We suggest that all documents used for determining the surplus or deficiency be placed in vehicle record folders and retained there for at least two years from the date of disposition. Such folders should be clearly identified as repossession files and segregated in the dealership’s records.

The dealership should make the same efforts (consistent with legal requirements) to obtain the best possible price for a repossessed vehicle as the dealership would make for a comparable used vehicle. This means the same standard should be applied in determining appropriate reconditioning and disposition measures, except that a warranty for repossessed vehicle need not be offered as part of the vehicle sale price even if the dealership provides such warranties on non-repossessed used vehicles. Where laws applicable in your area require specified treatment of repossessed vehicles, such as disposition by public sale or disposition within a specified period after repossession, such laws must be observed. You should still attempt to obtain the best possible net return consistent with those laws.

The dealership should not obtain waivers to defeat customers’ surplus or redemption rights, except in the precise manner and under the precise circumstances contemplated by the applicable state law versions of Sections 9-620, 9-621, 9-622, and 9-624 of the Uniform Commercial Code. A waiver of a customer’s right to a surplus may not be sought unless the dealer intends to return the collateral for its own use for the immediate future rather than to resell the collateral in the ordinary course of business. If a waiver is sought, the dealer should not represent that by proposing the waiver it proposes to forego its right to deficiency judgment, unless it intends to seek such a judgment should the waiver not be given. Remember – the taking of such waivers, except in the very limited circumstances describes above, may expose the dealer to legal action by the Federal Trade Commission and, depending on state law, by state law enforcement agencies or consumers. Therefore, you should consult with your attorney before attempting to take any such waiver. If you take a waiver, you should place and keep in the repossession file all documents relating to the repossession, handling, repair, retention and ultimate sale or lease (if any) of the vehicle.

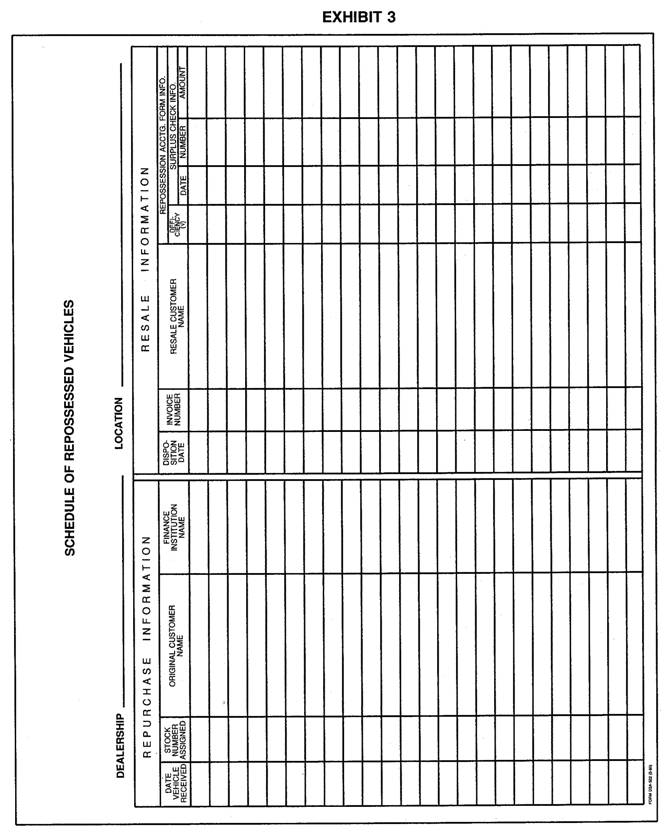

The dealership should maintain a list of its repossessions. The list may be kept by the dealership on a form modeled after the Schedule of Repossessed Vehicles (Exhibit 3). The Dealer Repossession Accounting Form, a copy of which is attached to these instructions, should be completed for each repossessed vehicle. The following instructions explain how to complete the form.

The amount of any surplus or deficiency should be calculated as follows:

A. Net Selling Price (Adjusted by underallowance or overallowance as described on Page R3.

B. Add: Insurance and Service Contract Reimbursements Received, Insurance Claim Payments, and other amounts received (describe).

C. Deduct: Insured Damage Repairs, where such repairs have been effected, and Dealer Payoff.

D. Equals: Subtotal.

E. Deduct: Allowable Expenses (as defined in this procedure) incurred by the dealership.

F. Equals: Subtotal.

G. Deduct: Allowable Expenses of the financing institution and any adjustments made by the financing institution to the contract balance in computing the Dealer’s Payoff to the extent they are to be reimbursed to the financing institution by the dealership, perfected subordinate security interests in the vehicle that are allowed by state law and satisfied by the dealership out of the proceeds of sale, and other obligations owed to the dealership by the financing customer relating to the contract balance.

H. Equals: Surplus to be Refunded to the financing customer or Deficiency on the repossession.

Items A, B, C, E, and G should be derived from the appropriate vehicle record files. Place in these files all records used in preparing the Dealer Repossession Accounting Form.

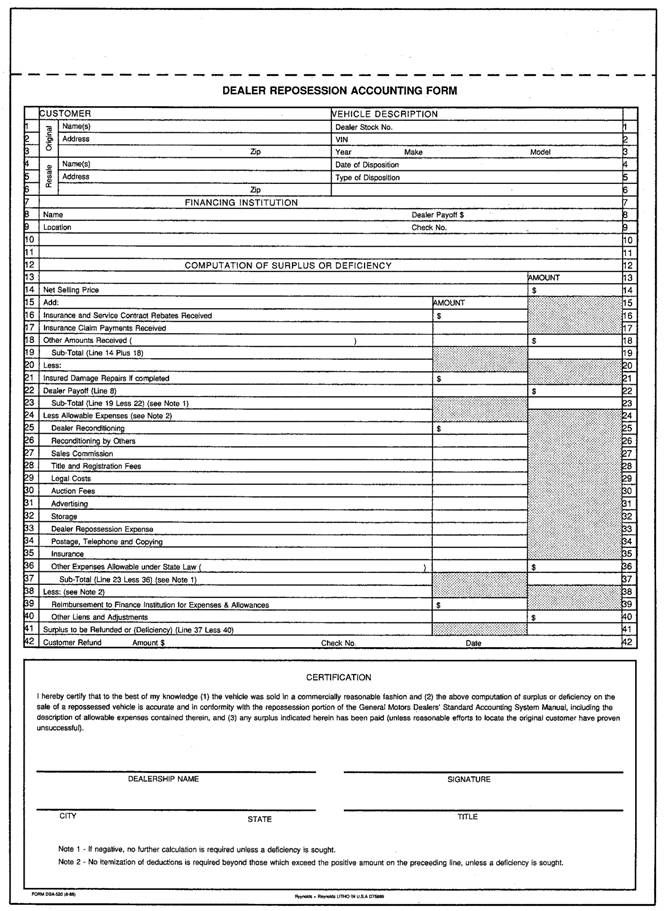

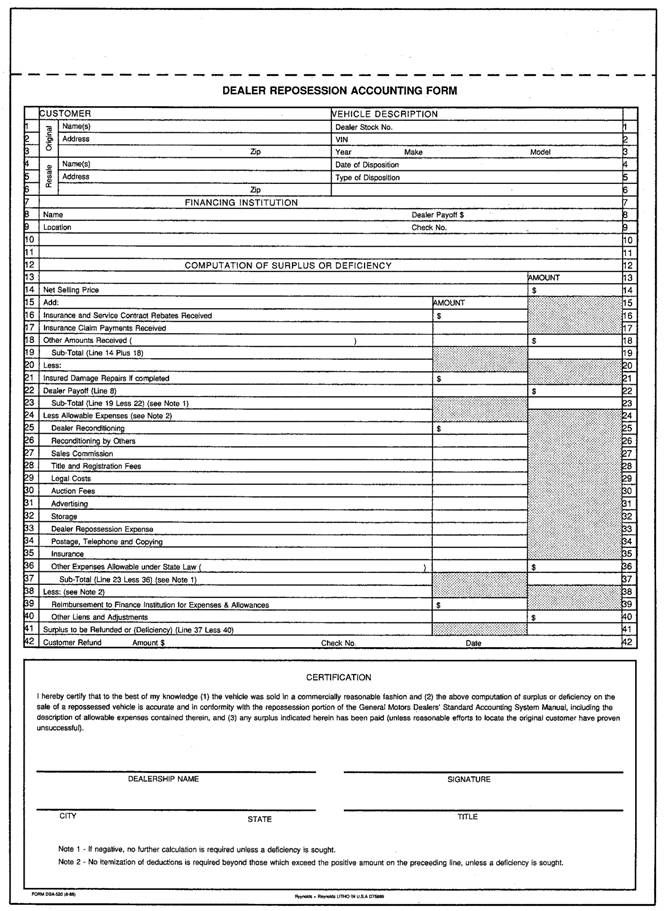

Record the name and address of the financing customer(s) on Lines 1, 2 and 3. Record the name and address of the new purchaser on Lines 4, 5 and 6. Information on Lines 4, 5 and 6 will not appear on the copy, which, as explained on page R9, should be sent to the financing customer(s) if there is a surplus or if a deficiency is sought. The name and address of the new purchaser should not be provided to the financing customer(s).

Describe the vehicle on Lines 1, 2, and 3. The date of disposition to be recorded on Line 4 is:

(1) the date of the execution of a binding retail installment contract, if a credit transaction;

(2) the date of the final settlement, if a cash transaction; or

(3) the date of execution of a binding lease, if a lease transaction.

The type of disposition should be entered on Line 5, using one of the following descriptions: private party, dealer, junk, lease, leasing company, auction, or other as applicable.

The name and location of the financing institution should be recorded here. The amount of the dealer payoff and the related check number should also be recorded.

The Net Selling Price to be entered on Line 14 is the price at which the vehicle was disposed of to an independent third party. In determining the Net Selling Price, the dealership should not use dispositions in which the purchaser is the dealership, the financing institution or a representative of either or use an estimated “actual cash value”. Such practices may expose the dealership to legal action by the Federal Trade Commission and, depending on state law, by state law enforcement agencies or consumers. In determining the Net Selling Price, amounts charged the buyer of the repossessed vehicle for any finance charges, insurance premiums, service contract charges, sales taxes, document and official fees, and other charges customarily imposed on the sale of used vehicles should be excluded. Also any separately priced services or accessories itemized in the vehicle sale or lease agreement or invoice, such as a separately priced warranty, or equipment added by or on behalf of the dealer (e.g., custom sound system, DVD entertainment system) should be excluded from the Net Selling Price, and the cost of such items should not be included in the allowable expenses, Lines 25 through 36.

If the disposition is by lease rather than sale, the Net Selling Price is the cash value of the lease at the time it is executed. The cash value equals the sum of the principal payments called for in the lease plus the residual value at the expiration of the lease, discounted by the discount rate offered by the financing institution primarily used by dealer for the retail financing of that type vehicle at the time the lease is executed. A copy of the sales or lease invoice for the repossessed vehicle should be placed in the vehicle record file.

An overallowance on a vehicle received in trade is a subtraction from the selling price; an underallowance on a vehicle received in trade is an addition to the selling price. An adjustment for overallowance or underallowance should be made only if that is the normal practice of the dealership and if it is not prohibited by law. Any underallowance realized on the disposition may be added in determining the Net Selling Price if overallowances are deducted on the disposition of other repossessed vehicles. The amount of any overallowance given on such a disposition may be deducted in determining the Net Selling Price if:

(1) the amount so deducted was determined at the time of disposition and is no greater than the excess of the trade-in allowance over the wholesale value of the vehicle taken in trade on the repossessed vehicle as that value is shown in a currently recognized guidebook used in the area, including condition adjustments where applicable;

(2) overallowances are given and contemporaneously recorded in the normal course of the dealership’s handling of non-repossessed vehicles; and

(3) underallowances are included by the dealer in the proceeds of other repossessed vehicle dispositions wherever applicable. The relevant portion of the guidebook used in determining the value of the trade-in should be photocopied and placed in the vehicle record file.

The following items should be added to the Net Selling Price:

A. The unearned portion of the gross insurance premium and service contract charges (including portions identified as dealer commission) with respect to any coverage for which the dealer was the agent or which is received by the dealer from the carrier;

B. All insurance claim payments received; and

C. All other amounts received in connection with the repossessed vehicle (describe).

NOTE: If warranty or service contract work has been performed for which reimbursement has been or is to be received, such reimbursement should not be added on Line 18, and no deduction should be made on Lines 25 through 36 for the corresponding repair work. If payment on a service contract has been made and the corresponding work will not be done, include the amount received on Line 18.

Where appropriate, the dealer should promptly apply to insurance carrier for reimbursements with respect to any financed insurance or other coverage and promptly submit appropriate claims for covered collision or other damage. Copies of checks, receipts or other evidence of such payments should be placed in the vehicle record file.

The following items should be deducted from Line 19

A. The amount of insured damage paid by insurance carrier, plus the deductible portions not paid by the carrier. The amount of insured damage may be deducted only if the related repairs have been completed.

NOTE: If the repairs are completed, the cost of such repairs should not be included under Allowable Expenses (Lines 25-36 below). In the event of uninsured damage the cost of repairs should be included as Allowable Expenses (See NOTE, Page R6).

B. The dealer payoff (this is the amount paid to the financing institution by the dealer under its recourse obligations after deduction of the finance charge reimbursement and other appropriate adjustments, if any).

Copies of checks, receipts or other evidence of such payments (or insurance estimates) should be placed in the vehicle record file.

If negative, no further calculation is required unless a deficiency is sought.

No itemization of deductions in Lines 25-36 should be made beyond those, which exceed the positive amount on Line 23, unless a deficiency is sought.

The expenses of reconditioning and repairs at a dealership’s facilities should be charged at the dealership’s direct cost. (See below.) Reconditioning and repairs performed by others should be charged at the dealership’s direct cost. (See below.) Post-disposition reconditioning and repairs should be charged only when specifically required in writing in the vehicle sale or lease agreement and performed within 45 days of the date of sale. Parts and labor provided under a warranty or service contract should not be charged to the vehicle.

Only commercially reasonable expenses that are allowable under state law should be deducted, such as the expenses listed below. Dealers could risk legal action by the Federal Trade Commission and, depending on state law, by state law enforcement agencies or consumers for deducting expenses other than expenses reasonably incurred as a direct result of the repossessing, holding, preparing for disposition and disposing of the vehicle and not otherwise reimbursed to the dealership or prohibited by law. Thus, fixed costs, overhead, profit on the disposition of the vehicle, and financing and insurance income lost as a result of the repossession should not be deducted. In addition, the dealership should consult its attorney to determine whether any items of expense listed in these procedures are not permissible deductions under the law of the state in which the dealership operates.

Each expense should be entered under the appropriate heading (Lines 25 through 36) and should be supported by a repair order, invoice, receipt, cancelled check or other business record which demonstrates that the expense was incurred in relation to the particular vehicle. Copies of all supporting documents should be place in the vehicle record file.

Line 25 - Dealer Reconditioning

Labor and associated parts and supplies furnished by the dealership for the repair, reconditioning, or maintenance of the vehicle in preparation for disposition, including legally required inspections, should be computed at the following cost rates:

I. The cost rate for mechanical or body work should be based upon the average hourly rate for mechanical technicians employed in the retail repair shop (for mechanical work) or for body/paint technicians employed in the retail body shop (for body work), which should be computed at either

(a) the average hourly base rate for the category of technicians (mechanical or body/paint), plus twenty (20) percent of that average hourly base rate for fringe benefits, or

(b) the sum of the average hourly base rate for that category of technicians, plus the average hourly cost for those voluntary and legislated fringe benefits for that category of technicians, to the extent those benefits are allowed under the form of Option B (Formula Rate) of the GM plan for reimbursing dealers for warranty, policy and adjustment work in force as of January, 1985. The time factor of the cost of such work should be based upon actual time spent, except that the flat rate may be used if the dealership customarily pays its technicians on a flat rate basis.

NOTE: If the dealer charges its customers on the basis of flat rate time but pays its technicians based on actual time, then actual time should be used in the technicians’ labor calculation.

Copies of payroll or other records used in this calculation should be placed in the vehicle record file.

II. The time factor of the cost for labor for other reconditioning clean-up and preparation work should be based on actual time spent on the vehicle. The cost rate should be computed at either

(a) the base hourly wage rate for the employees involved, plus twenty (20) percent of the base hourly wage rate for the fringe benefits, or

(b) the sum of the average hourly base rate for that category of employees, plus the average hourly cost for those voluntary and legislated fringe benefits for that category of employees, to the extent those benefits are allowed under the form of Option B (Formula Rate) of the GM plan for reimbursing dealers for warranty, policy and adjustment work in force as of January, 1985. Copies of payroll or other records used in this calculation should be placed in the vehicle record file.

III. The cost rate for parts utilized from dealership inventory should be based on the dealership’s cost for those parts as listed in the current manufacture’s catalog. All other parts should be deducted at actual cost.

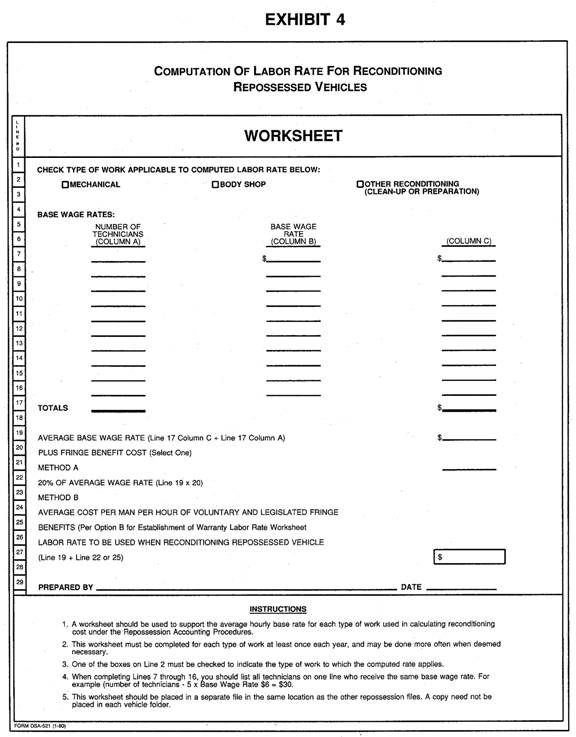

IV. (a) The calculation of average hourly base rate for technicians should be based on a form modeled after the attached Computation of Labor Rate for Reconditioning Repossessed Vehicles Form (Exhibit 4). The dealer need not calculate average wage rates more than once each year, but may do so more often if it chooses. The form should be placed in a file to be kept with the other repossession files, but a copy need not be placed in each vehicle folder.

(b) Where the dealer is basing fringe benefit expenses upon Option B (Formula Rate) of the GM plan for reimbursing dealers for warranty, policy, and adjustment work, the calculation should be supported by an Option B worksheet of the kind normally used by the dealer in calculating reimbursement under Option B. The dealer should use Option B worksheet only to calculate fringe benefits (do not go beyond Line 8 on the Option B summary). The dealer need not calculate fringe benefits under Option B more than once each year, but may do so more often if it chooses. This form should be placed in a file to be kept along with the other repossession files, but a copy need not be placed in each vehicle folder.

NOTE: The cost of insured damage repairs completed should not be included under Allowable Expenses, since they have been reflected on Line 21. If there was uninsured collision damage, the cost of repair should be included on Lines 25-36, since the repair cost has not been offset.

Line 26 – Reconditioning by Others

Amounts paid to others for labor and associated parts and supplies purchased for the repair, reconditioning or maintenance (including legally required inspection) of the vehicle in preparation for resale. Copies of checks, receipts or other evidence of such payments should be placed in the vehicle record file.

Line 27 – Sales Commissions

Commissions paid for actual participation in the disposition of the particular vehicle, computed so that the total amount is no higher than that applicable for the sale or lease, as applicable, of a similar, non-repossessed vehicle in similar circumstances and excluding portions of commissions attributable to the selling of service contracts, separately priced warranties, financing or insurance. The amount so determined may be increased to include voluntary and legislative fringe benefits incurred as a direct result of payment of the commission. This includes amounts such as FICA and federal and state unemployment taxes, which are determined on the basis of the amount of commissions paid. The dealer should not include the cost of fringe benefits, which are not determined on the basis of commissions paid, such as the use of a demonstrator, medical insurance, etc. Copies of checks, receipts or other evidence of such payments, including a document showing the manner in which fringe benefits have been calculated, should be placed in the vehicle record file.

Line 28 – Title and Registration Fees

Fees paid to others to obtain title to the vehicle, to obtain legally required inspection of the vehicle, or to register the vehicle. Copies of checks, receipts or other evidence of such payments should be placed in the vehicle record file.

Line 29 – Legal Costs

Filling fees, court costs, cost of bonds, fees and expenses paid to a sheriff or similar officer, and fees and expenses paid to an attorney who is not an employee of the dealer or the financing institution for obtaining possession of or title to the vehicle. Copies of checks, receipts or other evidence of such payments should be placed in the vehicle record file.

Line 30 – Auction Fees

Fees and expenses paid to others for auctioning the vehicle, including no-sale fees. Copies of checks, receipts or other evidence of such payments should be placed in the vehicle record file.

Line 31 – Advertising

A proportional share of expenditures for advertisements that specifically mention the particular vehicle. Copies of checks, receipts or other evidence of such payments and, of the extent available, of the advertising tear sheet or the printed advertisement should be placed in the vehicle record file.

Line 32 – Storage

Expenses paid to others for storage (excluding a charge for storage at facilities operated by the dealership). Copies of checks, receipts or other evidence of such payments should be placed in the vehicle record file.

Line 33 – Dealer Repossession Expense

Expenses paid to others, not employees of the dealership or the financing institution that financed the vehicle, for repossessing, towing or transporting the vehicle. This includes payment of any amounts necessary to obtain possession of the vehicle. Copies of checks, receipts or other evidence of such payment should be placed in the vehicle record file.

Line 34 – Postage, Telephone and Copying

Expenses paid to others for telephone calls, postage, other communications expense and photocopying necessary in arranging for the repossession, holding, transportation, reconditioning and disposition of the vehicle. Copies of checks, receipts or other evidence of such payment should be placed in the vehicle record file.

Line 35 – Insurance

NOTE: The dealer may ignore this possible deduction because of the complexity of calculation and the small amount involved.

Premiums paid specifically for insurance on the repossessed vehicle while in the dealer’s possession. Where the insurance invoice does not separately identify the portion of the premium attributable to that vehicle, the dealer should ascertain the amount (if any) by which the premium was increased because the particular vehicle was in inventory. For example, under some insurance agreements the premium is based on actual inventory data at specified intervals. For example, assume the dealer pays for such insurance at the rate for $2 per month per $1,000 of inventory value with the inventory reported at each month’s end and the repossessed vehicle has an inventory of $2,000 and is in the dealer’s inventory at the month’s end. The dealer’s out-of-pocket cost of such insurance which may be deducted as an allowable expense would be $4 ($2,000 [inventory value] x 1 [number of months] x $2/$1,000 [monthly premium per dollar inventory value] = $4). If the repossession were involved in two such premium-determining inventories, the amount allowable would be twice as much. If the dealer makes such calculation, the vehicle record file should include copies of the relevant premium invoice(s) and of the insurance company or agent’s letter or other statement indicating the cost basis upon which the calculation was made.

Line 36 – Other Expenses Allowable Under State Law

Other expenses paid (describe) that are allowable under state law and that are not included on Lines 25-35. Copies of checks, receipts or other evidence of such payments should be placed in the vehicle record file.

Line 37 – Subtotal

If negative, no further calculation is required unless a deficiency is sought.

Line 38

No itemization of deductions on lines 39-40 is required beyond those, which exceed the positive amount on Line 37, unless a deficiency is sought.

Line 39 – Financing Institution Expenses and Allowances

Indicate financing institution expenses and allowances that were not paid by the dealership in the payoff amount but which, under terms of the financing plan, the dealership is to reimburse the financing institution contingent upon the availability of customer funds to cover such reimbursement.

a. If the amount on Line 37 is positive, payment of the amount on Line 39 or Line 37, whichever is lower, should be made to the financing institution within a reasonable time after disposition. A copy of the check or other evidence of payment should be placed in the vehicle record file.

b. If the amount on Line 37 is negative, no entry is required on Line 39 unless a Deficiency is to be sought. If a deficiency is to be sought, the amount of financing institution expenses and allowances to be paid will be entered on Line 39 for purposes of developing the total Deficiency amount. Evidence of the amount of these expenses and allowances should be placed in the vehicle record file. Payment should be made to the financing institution upon collection of the Deficiency. Copies of checks, or other evidence of such payment(s) should be placed in the vehicle record file.

Line 40 – Other Liens and Adjustments

Indicate any perfected subordinate security interest (liens) provided for by state law and satisfied by the dealership out of the proceeds of disposition, including where the dealer made payment to the financing institution in connection with the retail installment contract and received with respect thereto a perfected subordinate security interest.

Also include any amount owed to the dealer by the financing customer where the financing customer failed to make promised down payments or where the financing customer’s obligation on a trade-in used in the purchase of the repossessed vehicle was greater than the amount represented at the time retail installment contract was executed. However, the dealer should consult with its attorney to determine whether these items are considered under state law to be part of the secured indebtedness owing on the contract.

Copies of checks, receipts or other evidence of such payment or obligations should be placed in the vehicle record file.

Line 41 – Surplus to be Refunded or (Deficiency)

A positive balance remaining on Line 41 should be forwarded to the customer. The check should be accompanied by a copy of the Dealer Repossession Accounting Form and should be sent within a reasonable time of the date of disposition.

CERTIFICATION

The Dealer Repossession Accounting Form should be reviewed and signed by a dealership official authorized to sign retail installment contracts on behalf of the dealership.

MAILING PROCEDURES

The check and form should be set by first-class mail to the financing customer’s last residence address known to either the dealership or the financing institution.

The dealership need not, but may, send the check and form by certified mail. However, if the certified letter is returned because delivery is refused, the dealership should retain the receipt and re-send the check and form by first-class mail to the last residence address known. If the check is returned undelivered after the first-class mailing, the return envelope should be retained and the check and the form should be sent to the most recent of the following known addresses: the last employment address known to either the dealer or the financing institution; the address provided by the military locator service (see Exhibits 1 and 2) if the financing customer’s last known employment is the military; or the address of a co-signer, relative or other person through whom the customer may be reached. The cancelled check and dealership’s copy of the Dealer Repossession Accounting Form shall constitute proof that the surplus was paid and the form was sent. If they are re-mailed, this should also be reflected on the form. The dealership’s copy of the form, copy of the check and returned envelope should be placed in the vehicle record file.

LATE REIMBURSEMENTS, CREDITS AND OTHER PAYMENTS

In the event of a reimbursement, credit, or other payment is received after the surplus has been paid, a second check for this amount should be sent in the same manner; if such a reimbursement, credit or payment is received after a prior computation indicated that there was no surplus, a revised computation should be made, and if a surplus results, it should be paid. In either event, payment should be made within a reasonable time of disposition or within a reasonable time of receiving the reimbursement, credit or payment, whichever is later.

DEFICIENCIES

If at any point in completing the Dealer Repossession Accounting form a negative balance is shown, the form need not be completed beyond that point unless the dealership wishes to seek a Deficiency from the financing customer. If the dealership wishes to seek a Deficiency, a Dealer Repossession Accounting Form completed in accordance with these instructions should be sent to the customer. Legal counsel should be consulted to determine whether and in what instances deficiencies may be collected under applicable law. Copies of any documents relating to the calculation or collection of a Deficiency should be kept in the vehicle record file.

RECORD RETENTION

The vehicle record folders for repossessions should be segregated and readily retrievable in the dealership’s files. Each such folder should contain all underlying documentation for the entries made on the Dealer Repossession Accounting Form (including a copy of a document, such as a used car record card, showing the value of any vehicle received in trade on the sale of the repossession). All such files and the dealership’s list of repossessions should be kept for at least two and preferably three years after the disposition of the repossessed vehicle.

LEGAL LIABILITY

Failure to adhere to the practices recommended above, or to account properly to customers for surpluses, may expose the dealer to legal action by the Federal Trade Commission and, depending on state law, by state law enforcement agencies or consumers.

ACCOUNTING INSTRUCTIONS

For purposes of the dealership’s financial accounting, the disposition of a repossessed vehicle should be recorded in the same manner as any other used vehicle sale. In addition, any payment due to the financing customer should be recorded as a credit in Account 220, Accounts Receivable-Customers. The offsetting entry should be recorded as a debit to Account 853, Repossession Losses – New or Account 854, Repossession Losses – Used.

EXHIBIT 1

|

BRANCH OF SERVICE |

ADDRESS AND PHONE |

FEE |

|

U.S. Air Force

|

U.S. Air Force World Wide Locator AFPC/MSIMDL 550 C Street West Suite 50 Randolph, AFB, TX 78150-4752

Phone: 210-652-5774 |

$3.50 Payable to Treasurer of the United States |

|

U.S. Army

|

Commander U.S. Army EREC Attn: Locator 8899 East 56th Street Fort Benjamin Harrison, IN 46249-5301

Phone: 317-542-4211 |

$3.50 Payable to Treasurer of the United States |

|

U.S. Navy

|

Commander Navy World Wide Locator Naval Military Personnel Command Locator Services Pers-312F 5720 Integrity Drive Millington, TN 38055-3120

Phone: 901-874-3383 |

$3.50 Payable to Naval Military Personnel Command |

|

U.S. Marines

|

Headquarters - U.S. Marine Corps Personnel Management Support Branch (MMSB-10) 2008 Elliot Road Quantico, VA 22134-5030

Phone: 703-784-3941 |

$3.50 Payable to U.S. Treasury Personnel Command |

|

U.S. Coast Guard

|

Commandant U.S. Coast Guard Coast Guard Personnel Command (CGPC-adm-3) 2100 2nd. Street S.W. Washington, DC 20593-0001

Phone: 202-267-1340 |

None |

EXHIBIT 2

(Military Personnel Locator Inquiry)

(Addressee)

(See Exhibit 1)

RE: (Complete Customer Name)

(Social Security No.) and/or

(Service No.)

(Rank, If Known)

(Age or Birth Date, If Known)

Dear Sir:

We are endeavoring to communicate with (customer name) in order to pay this customer some money. Please advise of the latest duty station and address where we may correspond. Our check in the amount of $(see Exhibit 1) is enclosed for your handling fee.

A stamped self-addressed envelope is enclosed for your reply.

Sincerely,

(Name)

(Title)